Every trader dreams of the big trades where profits run and the trend is perfectly exploited. In this article we will show you how to proceed and what to look for if you want to trade with a risk-reward ratio (R/R ratio) of 5 or more.

More...

The right market movement

From my experience, trades with a high risk-reward ratio are not random products that develop in the process of the trade, but are systematically planned in advance.

The first thing is to find a correspondingly strong market movement (trend) that can either be continued or corrected. Both are equally likely, but this is sufficient for me, because a low hit rate is sufficient for trades with a very high risk-reward ratio.

Appropriately strong market moves to consider are, for example, price swings during important data. In our case, we observed the strong price increase of over 300 points in the DAX during the ECB interest rate decision.

This gives me a very strong market movement that we can trade either as a continuation or as a correction.

In our case, we decided to trade in the direction of correction, as our analyses show that strong market movements due to news such as US labour market data or interest rate decisions tend to be corrected again to a very large extent.

Find entry with narrow SL

The price movement has been found and the trade direction with "short" as well. Now we need the right setup to enter short at a suitable point. Furthermore, this must be a setup that manages with a narrow SL (stop-loss) so that a high risk-reward ratio is possible at all.

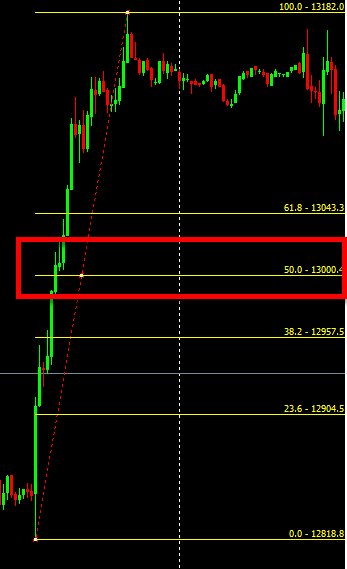

In our case we used a Fibonacci setup to enter short near the daily high.

Since the current daily volatility (distance from the high to the low) was not yet high this morning, one automatically achieves an entry with a narrow SL with the help of the Fibonacci retracement.

This looked like this:

Key data:

- Trend is weakening, the trend line from the high yesterday to the current high of the red candle at around 8:00 is falling.

- Fibonacci retracement is created from the low of the day and shows the next resistance at 118%. This is identical to the trend line and just before the old daily high, which also serves as resistance.

- SL is placed according to our rules 2.1 points + spread above the 138.2%, which signals the next important resistance.

- Entry thus at 13,161.4 (positive slippage, order was at 60.6 as seen in the chart) with SL at 13,174.2.

- Risk of 12.8 points. Quantity was set automatically based on the desired risk in Euros by EA FiboExpert.

With a point risk of 12.8, I now had a very good chance of a trade with a high risk-reward ratio if the price took the predicted development and corrected some of the 300 point rise.

Find TP and manage trade

A rough estimate of how much the price can correct is of course necessary. Please always bear in mind with such trades that you have to give the price a lot of breathing space, a tight stop-loss in profit usually only leads to you being stopped out with a small profit.

As a good and useful rule, one can remember the following:

The price can correct 50% of the underlying movement with a good probability.

To do this, we again draw a Fibonacci retracement on the chart and place the 0% at the beginning of the movement and the 100% at the end of the movement. The Fibonacci retracement automatically shows me the 50% line. This gives us our rough target of 13,000 points, which is also a psychologically important mark.

As mentioned earlier, we want to give the price plenty of room to breathe in order to avoid an unfavourable stop-out.

If you are also satisfied with 3R (What does "R" mean? Click here.) in such a trade you will be possibly annoyed when you give away a nice profit again, you should speculate on exactly the 3R from the outset. For higher profits it is absolutely necessary to be prepared in advance and to accept that not every attempt will work out. If every fourth setup runs according to this category, that is already very profitable trading.

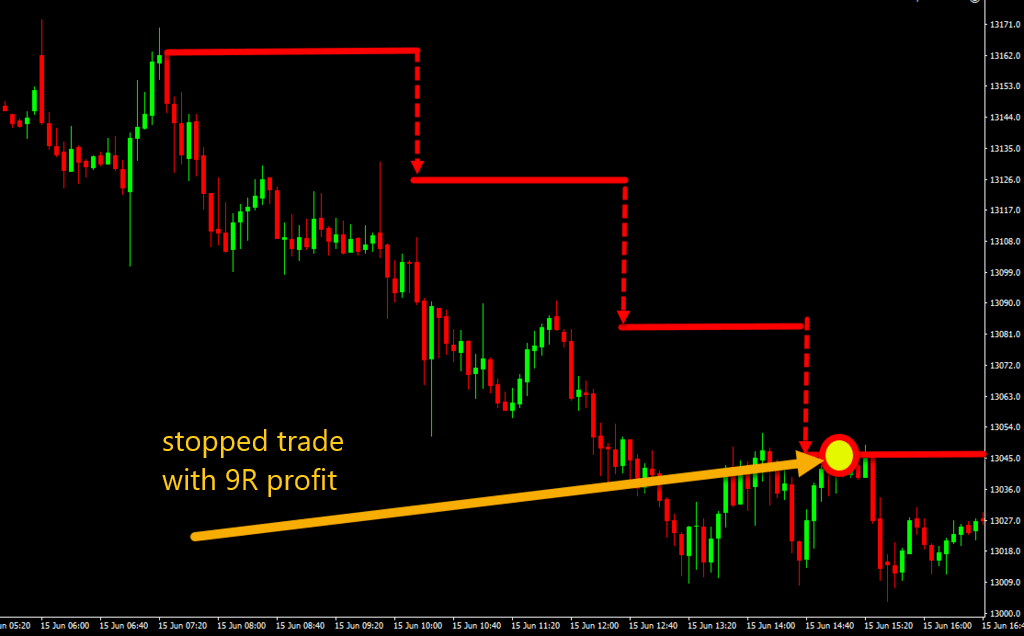

In our case, we set the stop-loss to entry price after it had run 12 points into profit. We always do this because although resistance is good according to our analyses, only the first bounce is likely. Currently, we are still in a long trend, which was initiated by the ECB interest rate decision and which must first be broken.

Next, we left the SL at entry price until the price actually and sustainably broke the daily low at around 13,100. You can see very nicely in the chart that the price needed almost 2 hours (!) to actually break this mark. If I pull the SL into profit here prematurely, I will most likely be stopped out with a few Rs profit. Not my intention of course.

Despite all the consistency and conviction that the price will continue to fall, it is enormously important not to exit the trade without making a profit after a certain point.

If, for example, I got a profit of 5R, I should realise a minimum profit of 2R if the price moves in the wrong direction. Usually, you can tighten the SL according to chart technique and with approx. 40-50 points of air:

You can see in this chart how I trailed the SL. It was important for me to wait for sustained breaks of the lows and to tighten the SL only with a very large gap. This gives the price the chance to "let off steam" at certain marks without the SL being caught.

When do I tighten the SL and when do I use the TP?

We only work with a trailed SL as profit protection with very high risk-reward ratios of 5 and higher.

If we trust a trade to have a risk-reward ratio between 2 and 5, in our experience it is much more lucrative to place the TP there and take the profit.

Result

Entry: 13,161.4

Stop-loss (inital): 13,174.2

Exit via SL at 13,045.5

Profit: 115.9 points = risk-reward realised of 115.9 points / 12.8 points = 9R profit.

It is up to you personally to decide which risk level R you want to trade. We do not want to suggest any values, it always depends on your personal circumstances, risk tolerance and the like.

What is important for us is that you can understand the advantage of the concept of the risk unit and that it always depends on what multiple I can achieve in a trade.

Emotionally, it is helpful to think in "R" terms. You detach yourself from sums of money and think more abstractly, which makes trading a little more rational again.